The last decade of technological development sometimes feels like something straight out of science fiction – stories about powerful computers, intelligent machines, and systems quietly running the world behind the scenes.

Except reality isn’t nearly as glamorous.

I’ve always been a strong believer in technology and innovation. The digital economy has created extraordinary tools, services, and opportunities. But every now and then it’s worth pausing and asking a more uncomfortable question: are we actually becoming more vulnerable?

Despite all the technological progress, our society increasingly depends on systems that must work 100% of the time. When they do – everything feels seamless. But when they stop, the consequences can be far more severe than in the past.

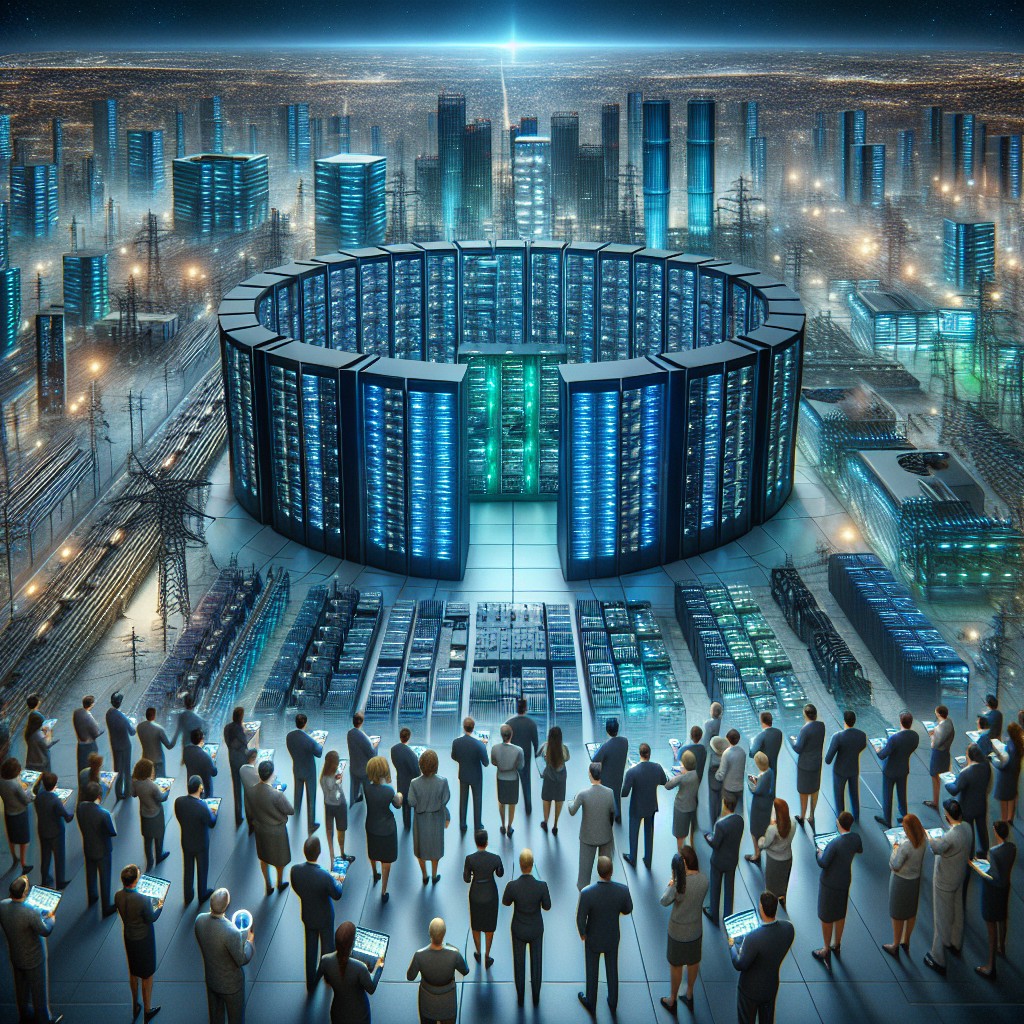

One of the biggest risks is centralization.

Massive digital platforms and hyperscale infrastructure have concentrated enormous amounts of computing power and data into relatively few locations. At the same time, true privacy is slowly disappearing as our lives become fully digitized.

Data centers are no longer just IT infrastructure. They have become critical national infrastructure – as important as energy grids or transportation systems.

And this changes how we should think about them.

Instead of relying solely on a few global hyperscale hubs, countries should be investing in regional and national data centers that allow digital services to remain operational even if larger global systems fail.

Geographic distribution is no longer just an engineering preference – it is a resilience strategy.

From a geopolitical perspective, major digital infrastructure sites can quickly become primary targets during crises or conflicts. That means governments, companies, and infrastructure providers must invest more into redundancy, security, and distributed architecture.

Of course, this comes at a price.

More resilience means more infrastructure. More infrastructure means more protection. And ultimately, higher costs for digital services.

So the real question might not be whether technology is advancing – because it clearly is.

The real question is:

Are we building a stronger digital world, or simply a more fragile one that requires constant protection?

As a data center infrastructure provider, I strongly believe that regional digital infrastructure matters more than ever. Countries should not rely solely on a few global hyperscale centers. Digital independence requires local capacity, distributed architecture, and strategic resilience.

Maybe it’s time to start thinking about digital infrastructure the same way we think about energy security.

Not as a convenience.

But as a national priority.

And perhaps this is the question we should all start asking ourselves.

Subscribe & Share now if you are building, operating, and investing in the digital infrastructure of tomorrow.

#datacenters #digitalinfrastructure #cybersecurity #geopolitics #cloudcomputing #digitalsovreignty #datacenterindustry #criticalinfrastructure #techstrategy #futureoftechnology

https://www.linkedin.com/pulse/digital-progress-dependence-andris-gailitis-2oetf